How I Budget with Quicken

Good morning friends!

As some of you know, I recently switched our personal finance software from Mint.com to Quicken. After several weeks of connectivity errors with our American Express account I became frustrated, I reached out to AMEX and was advised that they don’t support the Mint platform. The customer service rep then listed several applications they do work with, which included Quicken. After speaking with my Husband and discussing options for new budgeting applications, he was surprised to learn that I had actually never heard of Quicken, which after using this software is incredibly surprising. So, I dove head first (and a little nervous) into a new software to help us budget and keep track of our finances to reach our goals. And it changed how I managed our money.

Before we dive in, a couple of quick notes:

This post is not sponsored or endorsed by Quicken.

I like managing our money digitally, partially because I have arthritis in my hands and writing can be painful sometimes.

We are debt free.

We use an American Express credit card and we pay it off in full each month.

Personal finance is exactly that, PERSONAL. There is no wrong way to manage your money (except probably NOT managing your money?). I encourage you to research what products are out there and find a system that works for you!

Note: This post is in no way sponsored or endorsed by Quicken. All views are my own and not influenced by Quicken.

Quicken Background and Information

The Quicken software has had an interesting history. At one point, Quicken was part of Intuit Inc, which sold Quicken to H.I.G Capital on March 3, 2016 after it acquired Mint on November 2, 2009. If you take a look at both platforms (Mint and Quicken) there are some similarities, however each platform is completely unique. Unlike Mint and other cloud based programs, Quicken is installed directly to your computer hard drive. In essence, you download the program directly onto your computer (there are specific Mac and WIndows editions depending on what computer you’re using). You then link your bank accounts to the program which then synch approved and posted transactions. You can of course access your account through online (Quicken on the Web) and their app as well.

The Cost

So, how much does this cost me? I went from using Mint.com (which is free) to track, categorize and budget for our household to a paid yearly subscription. Quicken offers three tiers of subscription for Mac and four tiers of subscription for PC. Bellow are the options for Mac.

Starter: $34.99 / year. This option allows you to see all accounts in one place, categorize your expenses automatically and manage your money across desktop, web and mobile.

Deluxe: $49.99/ year (my choice) . This option is all the above plus creating a customized budget, manage and track debt and simplify your taxes and investments.

Premier: $74.99 / year. Everything from the top two plus free online bill payment and priority access to customer support.

I chose the Deluxe subscription model which allows me to fully utilize their budgeting tools. Broken down I I would be paying $3.74 per month for this subscription.

What Makes Quicken Different?

There are quite a few differences that I’ve found between the Quicken software and that of its competitors. Here’s a couple that I’ve highlighted:

No philosophy. Unlike many budgeting software programs, Quicken has no philosophy behind it. It is purley a blank slate to truly make your budget into whatever you want it to be.

No advertisements. Although I did love Mint because it was free, there was an abundance of advertisements that I found visually distracting.

All the financial outlets. I find Quicken to has the largest network of connected financial outlets including UK, Canada and I believe all the American financial institutions. Some budgeting programs only connect to specific financial outlets and omit others.

Tutorials. Quicken has an abundance of tutorials available on their YouTube page which made it incredibly easy to find answers to any questions I had and quickly set up our budget.

The cost. Quicken has the most inexpensive cost when i compared it to the current leaders in budgeting software (again, besides Mint which is free).

Multiple budgets. This was an interesting one for me because it actually never occured to me! Quicken allows you to set up and save MULTIPLE budgets. I created an emergency budget that I will activate if there is a crisis, which lets be honest just helps my anxiety if anything.

Using the Software

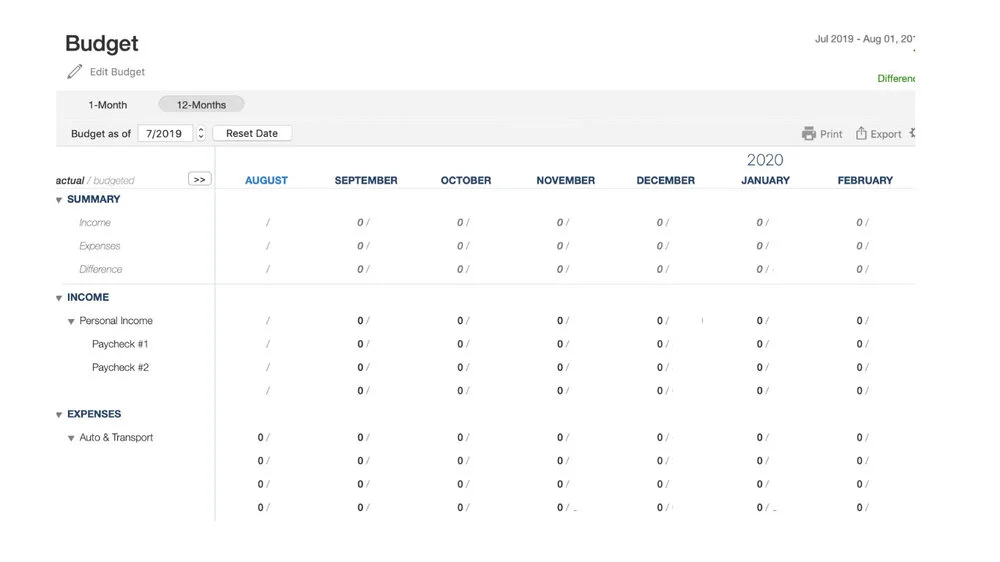

One of the things I instantly fell in love with was the yearly budget that Quicken offers that connects directly to their monthly budget. I was already using a yearly budget template that I created myself on Google Sheets, so it was beyond amazing to see a software that was offering the same thing. This meant that I could truly do all my budgeting from one platform instead of switching between two. Why do a yearly budget? Because budgets change MONTHLY. No two months are the same! A yearly budget allows you to plan ahead for upcoming months, input random bills and expenses and really keep on top of your finances.

Bellow: A snapshot of the monthly view from Quicken.

When I jumped into the program I simply used the numbers I had already inputted into my Google sheet yearly budget and transferred it over into Quicken to set up our budget. Setting up categories was quick and easy after referring to this tutorial that Quicken offered, and linking bank accounts was incredibly straightforward.

Just One More Thing

After exploring this software and setting up our budget, I can honestly say that it has been game changing. In the past, I have been anxious about ensuring transactions were correct and accounted for. I would check my online budgeting software multiple times a day just to make sure it was syncing correctly and updating into the right category. After implementing Quicken, I check in maybe once every couple of days because I KNOW that the transactions are downloading properly and the software is working exactly as it should.

Lastly, the Quicken software has so much more capability then just budgeting. You can pay bills, track investments, set alerts, view reports… the capabilities are truly amazing. I encourage you to check it out, watch some YouTube videos and read other reviews and give it a try!

Pitter Patter,

Lauren